are federal campaign contributions tax deductible

The answer is no. TurboTax Is the Best Way To Get Every Tax Credit You Deserve.

How To Claim A Deduction For Charitable Giving Tax Deadline Remote Jobs First Home Buyer

Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible.

. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. IRS Approved E-File Provider. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit.

The reader is encouraged also to consult the Federal Election Campaign Act of 1971 as amended 52 USC. Political contributions deductible status is a myth. AO 1993-12 Native American tribe as federal contractor.

Political contributions arent tax deductible. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

Can a deduction to a political campaign be deducted on the donors federal income tax return. This type of organization is. While tax deductible CFC deductions are not pre-tax.

But the federal tax code doesnt allow you to take. A tax deduction allows a person to reduce their income as a result of certain expenses. According to the IRS.

Although campaign contributions are not. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductible. How to get to the area to.

TurboTax Is the Best Way To Get Every Tax Credit You Deserve. Can I deduct my contributions to the Combined Federal Campaign CFC. Typically deductible charitable contributions are those made to organizations that are tax-exempt under 501c3 of the Internal Revenue Code.

According to the Internal Service Review IRS The IRS Publication 529 states. A corporation may deduct qualified contributions of up to 25 percent. For contributions to be honored as an official contribution the receipt must reside with you.

Generally you can only deduct charitable contributions if you itemize deductions on Schedule A Form 1040 Itemized Deductions. There are five types of deductions for. Generally a taxpayer is allowed a deduction for any.

Easy software finds deductions. 30101 et seq Commission regulations Title 11 of the Code of Federal. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done.

Check For the Latest Updates and Resources Throughout The Tax Season. Yes you can deduct them as a Charitable Donation if you file Schedule A. According to the IRS the answer is a very clear NO.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. However in-kind donations of goods to qualified. So you might feel that you deserve a tax break when you support the democratic process by making a campaign contribution.

Ad A Bit of Planning Now Can Keep You From Tax Filing Troubles Next Year. On the part of the. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done.

Check For the Latest Updates and Resources Throughout The Tax Season. Many believe this rumor to be true but contrary to popular belief the answer is no. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit.

A 75 tax deduction may be claimed for 400 contributed a 50 rate for any. The Combined Federal Campaign CFC makes automatic deductions from your salary each pay period and sends your gift to your chosen organization or cause within the CFC. Ad A Bit of Planning Now Can Keep You From Tax Filing Troubles Next Year.

While tax deductible CFC deductions are not pre-tax. However for 2021 individuals who do not.

Pin On Politics Current Affairs

Are Political Donations Tax Deductible Credit Karma Tax

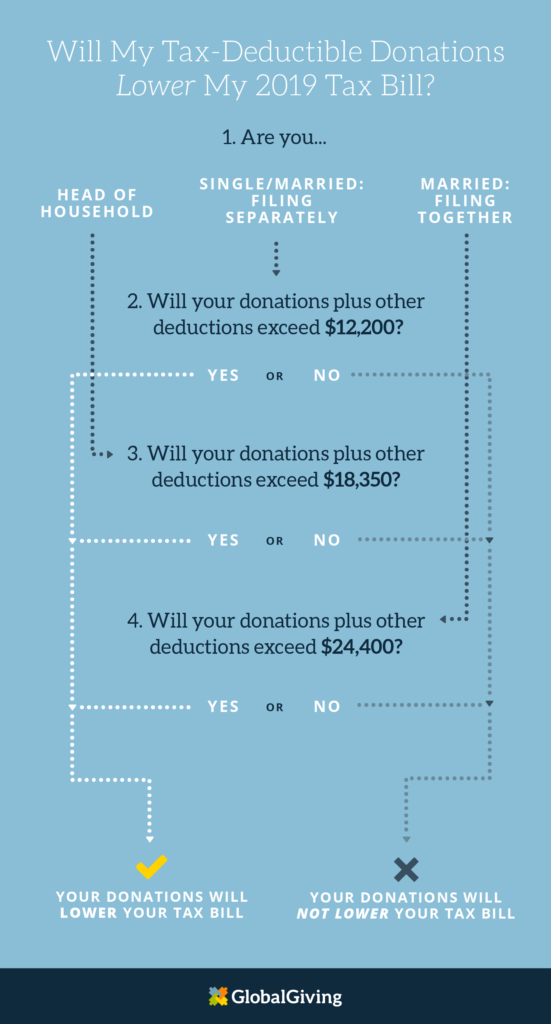

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

What Are Tax Deductible Medical Expenses Medical Billing Medical Debt Medical Billing And Coding

501c3 Tax Deductible Donation Letter Check More At Https Nationalgriefawarenessday Com 505 Donation Letter Template Donation Letter Donation Thank You Letter

Are Political Contributions Tax Deductible Personal Capital

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Website Design For Global Non Profit Mmi By Modassic Customized Wordpress Backend Video Backgr Nonprofit Website Design Medical Website Design Medical Design

Are Campaign Contributions Tax Deductible

Explore Our Sample Of Charitable Contribution Receipt Templat Charitable Contributions Charitable Receipt Template

The Cares Act Increases Donation Tax Deductibility Family Children S Services

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Tax Deductible Donations These Are The Conditions

Tax Stock Photos Images Pictures Business Tax Deductions Income Tax Return Income Tax

Are Your Political Contributions Tax Deductible Taxact Blog

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)